NATIONAL/INTERNATIONAL

Federal Loan Changes to Help Students

by John Filcik

President Barack Obama recently an-

nounced plans to ease student loan debt for

college graduates, plans that will affect Cedar-

ville students and graduates as well.

Creeping over the $1 trillion mark, stu-

dent loan debt has recently surpassed credit

card debt in America. Many say these numbers

call for reform, but it’s unclear what kind of re-

form is needed.

Fred Merritt, Director of Financial Aid at

Cedarville, agrees that the current system is

not entirely ideal.

“It’s a little bit scary,” Merritt said, “in

that some loan programs are now so easy to

get that students can wrack up pretty large stu-

dent loan balances just because the funds are

there.”

In an effort to amend the system to some

degree, President Obama has announced new

financial aid programs that aim to make it eas-

ier for college graduates to pay off student loan

debt. The new program consists of two main

components: a loan consolidation option and a

monthly payment minimization.

Two years ago, there were two federal loan

programs, but in 2010, Congress abolished the

Federal Family Education Loan (FFEL) pro-

gram, leaving only the Federal Direct Loan

Program (Federal Direct) for new borrowers.

Many borrowers who first took out stu-

dent loans before 2010 were left paying two

monthly payments, one for each type of loan.

As a result of Obama’s new programs, bor-

rowers have the opportunity between Jan. 1,

2012, and June 30, 2012, to consolidate both

loan payments into one monthly payment and

lower the interest rate on the loans.

It is predicted to affect the over six million

people who have at least one Federal Direct

Loan and one FFEL. Those in the Cedarville

class of 2012 or 2013 who took out student loans

before 2010 will be affected and, according to

Merritt, should take advantage of this incentive.

“Overall, it’s a great program,” Merritt

said. “Our students will be able to take advan-

tage of that and should because it’s to their ad-

vantage to do so.”

Not only is this part of the program ben-

eficial to borrowers, it also benefits the federal

government. The simplification of loan pay-

ments reduces risk of default, and the transfer

of FFEL loans to the Direct Loan program re-

duces costs for the Department of Education.

The second change to the existing pro-

gram involves minimizing monthly loan pay-

ments and providing loan forgiveness after 20

years. Under the current system, monthly loan

payments are limited to 15 percent of discre-

tionary income. President Obama’s new “Pay

as You Earn” plan minimizes monthly pay-

ments to 10 percent of discretionary income, a

plan that the administration estimates will re-

duce monthly payments for 1.6 million people.

For example, if a Cedarville student with

$25,000 worth of debt were to graduate and

obtain a teaching job that pays $30,000 a year

his monthly payment would amount to $171

under the current system. With Obama’s “Pay

as You Earn” plan, which goes into effect in

January, his monthly payment would be re-

duced to a more manageable $114.

The final facet of Obama’s plan allows new

borrowers who pay monthly payments for 20

years to have their student loan balance forgiv-

en. This is decreased from 25 years under the

current plan. Merritt said this wouldn’t have a

major impact on Cedarville students, however.

“On average a CU student graduates with

$20,000 in debt,” Merritt said, “so it’s not very

impactful for CU students because they will

have their loans paid off before that 20-year

limit.” Merritt said the high-end, student loan

debt mainly involves people pursuing post-

graduate degrees, whether that is from gradu-

ate school, medical school or law school.

Despite the advantages of the current

plan, Obama has drawn fire for his unwilling-

ness to allow Congress to vote on the matter.

Instead, he announced it in the form of an

executive order. Chelsea Gruet, a Cedarville

senior, doesn’t necessarily find fault with this,

however.

“I’m just glad someone’s doing something

in this economy to help college graduates pay

off their loans,” Gruet said. “The only thing I’d

be cautious about is giving loans to people who

really shouldn’t have them.”

Mike Clark, another Cedarville senior, of-

fered the suggestion that the president needs

to maintain a greater focus on securing the ini-

tial finances necessary for a student to attend

college.

“Loan forgiveness only helps those who

were fortunate enough to get into college in

the first place,” Clark said. “What good is loan

forgiveness, though, if you can’t even secure a

loan? I’d rather see more effort placed into get-

ting kids in school where they will have a better

chance to make a living for themselves.”

Merritt contended that Obama’s plans

wouldn’t substantially affect the current Ce-

darville financial aid programs.

“Here at Cedarville, we can put together

a financial aid package that makes it possible

for every student to attend Cedarville if they’re

willing to accept that package,” he said. “That

package will include student loans and may in-

clude parent loans, as well.”

Obama formally announced his new finan-

cial aid programs Oct. 26 in front of an audience

of University of Colorado students. He empha-

sized the effect the programs would have on al-

lowing American young people the ability to go

to college, make a future for themselves and not

be crippled by student loan payments.

Finally, the President emphasized the eco-

nomic benefits that would stem from the new

programs, both for individual Americans and

for the American economy as a whole. It would

help young people determine how to afford

college, help them have money in their pocket

upon graduation and as a result, help them be

more confident and able to buy a house and

save for retirement.

“[This program] will give our economy a

boost at a time when it desperately needs it,”

Obama said. “[It] is not just important to our

country right now; it’s important to our coun-

try’s future.”

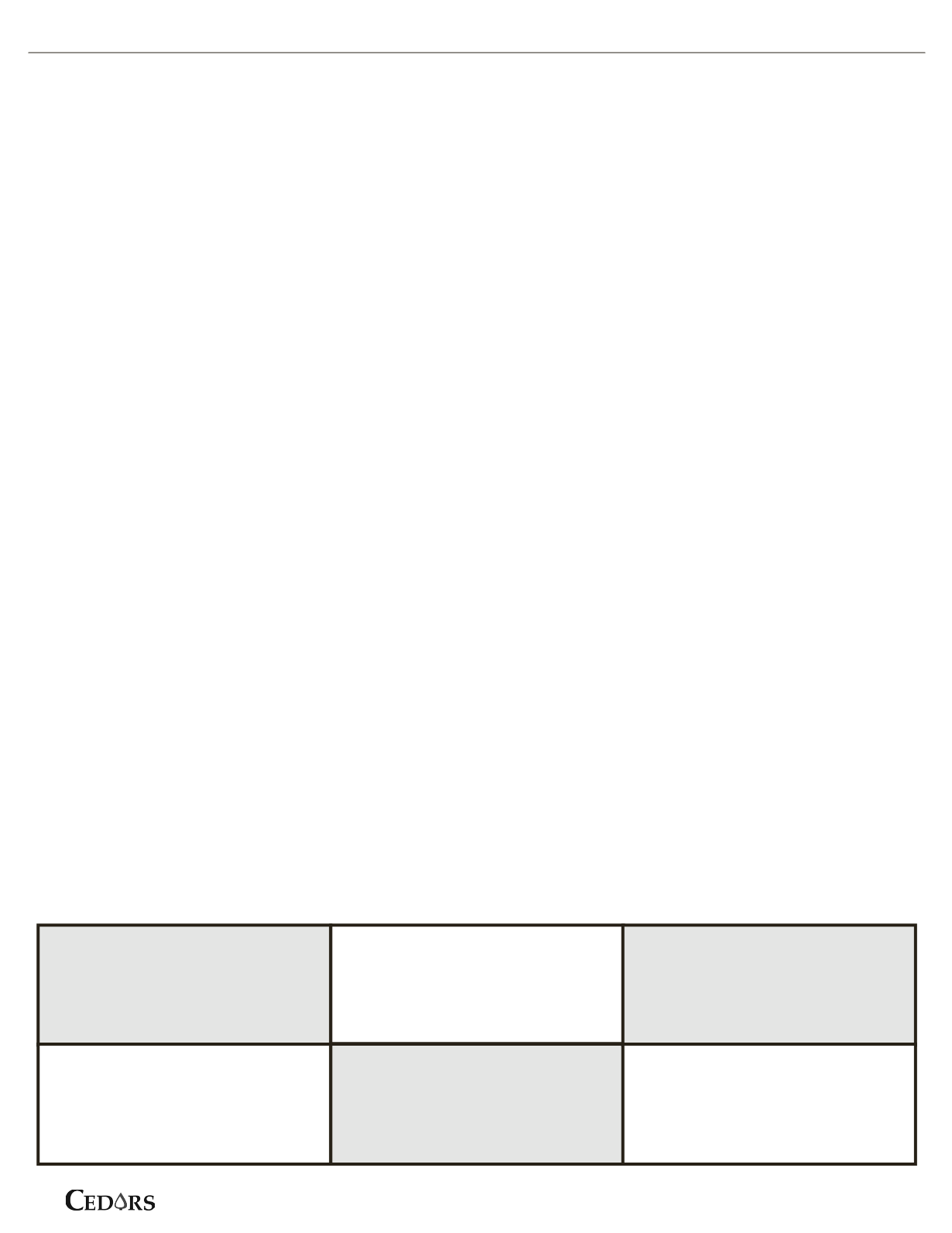

Student Loan Debt By the Numbers

Total Student Loan Debt in America

$1 trillion

Average Debt for a Cedarville Graduate

$20,000

People the Loan Consolidation

Program is Expected to Affect

6 million

People the Payment Minimization

Program is Expected to Affect

1.5 million

Years Till Loans are

Forgiven Under Current System

25

Years Till Loans are

Forgiven Under New System

20

More content updated daily at ReadCedars.com

12

December 2011

Sources: Fred Merritt and